Why in news?

- In the realm of finance, few concepts stir as much curiosity and debate as bond yields.

- Recently, the news has been abuzz with reports of record-breaking mobilization of funds through the auction of State Development Loan (SDL) Bonds by State governments.

What are Bonds?

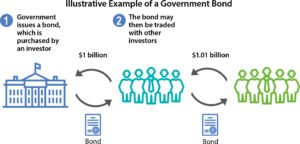

- Imagine you lend money to a friend and ask for a written promise that they’ll pay you back with interest.

- That written promise is like a bond a formal way of borrowing money. Bonds can be issued by governments or companies to raise funds.

What are the Different Types of Bonds?

- Treasury Bills (T-bills):

- Treasury bills are short-term debt instruments issued by governments to raise funds.

- They are issued at a discount to their face value and do not pay any interest.

- Instead, investors earn a return by purchasing the bills at a discount and receiving the full face value at maturity.

- T-bills typically have maturities of less than one year, making them popular for short-term cash management and liquidity needs.

- Cash Management Bills (CMBs):

- Cash Management Bills are another form of short-term debt instruments introduced by the Government of India in consultation with the Reserve Bank of India (RBI).

- Like Treasury bills, CMBs are issued at a discount to their face value and do not pay periodic interest.

- They are used to address temporary mismatches in the cash flow of the government and typically have maturities of less than 91 days.

- Dated Government Securities (G-Secs):

- Dated Government Securities are long-term debt instruments issued by governments to finance their fiscal deficits and other expenditure.

- Unlike Treasury bills and CMBs, G-Secs pay periodic interest, known as coupon payments, to investors.

- They have fixed or floating coupon rates and maturities ranging from 5 years to 40 years.

- G-Secs are considered relatively safe investments due to the sovereign guarantee backing them.

- State Development Loans (SDLs):

- State Development Loans are debt instruments issued by state governments to raise funds for various developmental projects and infrastructure initiatives.

- SDLs are similar to dated government securities but are issued by state governments instead of the central government.

- They are also long-term securities with fixed or floating coupon rates and maturities ranging from 5 years to 40 years.

- SDLs play a crucial role in financing state-level projects and meeting the borrowing requirements of state governments.

Understanding Bond Yields and RBI’s Management:

- Bond Yields:

- Bond yield represents the effective rate of return that a bond generates for its holder.

- Similar to the interest rate earned on savings accounts, bond yields indicate the income earned from holding a bond relative to its price.

- Unlike fixed interest rates, bond yields fluctuate based on factors such as changes in bond prices and coupon payments.

- RBI’s Management of Bond Yields:

- The Reserve Bank of India (RBI) employs Open Market Operations (OMOs) as a key tool to manage bond yields.

- Through OMOs, the RBI strategically buys or sells government securities in the open market to influence liquidity conditions.

- When the RBI aims to tighten liquidity and control inflationary pressures, it conducts OMOs to sell government securities, thereby reducing the money supply in the market.

- Conversely, when the RBI seeks to ease liquidity and stimulate economic growth, it conducts OMOs to buy government securities, injecting liquidity into the market.

- These actions by the RBI impact bond prices and yields, as increased demand for government securities drives up prices and lowers yields, while increased supply leads to lower prices and higher yields.

- By managing bond yields, the RBI aims to maintain stability in financial markets, regulate borrowing costs, and support the overall macroeconomic objectives of the country.

Impact of Hardening Bond Yields:

- When bond yields rise, it affects banks, mutual funds, corporates, and even equity markets.

- Increased borrowing costs, mark-to-market losses, and shifts in investor preferences are some of the repercussions of rising bond yields.

People also ask

Q1: What is bond yield, and how is it calculated?

Ans: Bond yield is the effective rate of return that a bond generates for its holder. It is calculated by dividing the bond’s annual interest payments by its current market price.

Q2: Why do bond yields fluctuate?

Ans: Bond yields fluctuate due to various factors such as changes in interest rates, bond prices, coupon payments, and market demand for bonds.

Q3: How does the RBI manage bond yields?

Ans: The RBI manages bond yields through Open Market Operations (OMOs), where it buys or sells government securities in the open market to influence liquidity conditions and bond prices.

Q4: What is the purpose of RBI’s management of bond yields?

Ans: The RBI manages bond yields to maintain stability in financial markets, regulate borrowing costs, and support macroeconomic objectives such as controlling inflation and stimulating economic growth.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.