Table of Contents

Introduction

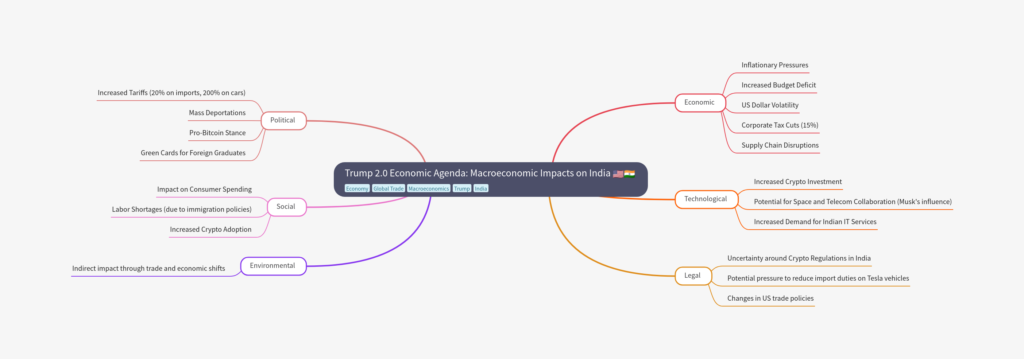

Donald Trump’s potential return to the White House comes with an ambitious and aggressive economic agenda, positioning it to disrupt both domestic and global markets. With proposed policies including a steep 20% tariff on imports, over 200% duty on cars, mass deportations, and extending tax cuts amidst a ballooning budget deficit, the “Trump 2.0” economic outlook could create a series of macroeconomic challenges.

As Trump moves forward with his policy plans, there are significant questions about how these changes will impact inflation, global trade relations, and foreign exchange stability. The possible ripple effects extend to India, a country that could experience unique challenges due to heightened trade barriers, supply chain volatility, and shifts in global monetary policy. This article explores these prospective changes, covering how each proposed policy might reshape global and domestic economic landscapes.

U.S. Tariffs and Trade War: Inflationary Pressures and Budget Deficit Woes

One of Trump’s most controversial proposals is a sweeping 20% tariff on all U.S. imports and a staggering 200% duty on cars. In a world dependent on interconnected supply chains, these tariffs risk sparking a global trade war, leading to higher inflation in the U.S. as imported goods become pricier.

Higher tariffs typically mean elevated production costs, leading businesses to pass on these expenses to consumers. This could contribute to an inflation surge in the U.S., straining household budgets and intensifying the budget deficit already at an all-time high. With reduced import competition, domestic prices may increase even further, impacting American consumer purchasing power and potentially slowing economic growth.

Moreover, if inflation surges in the U.S., it could also impact foreign investor confidence. Historically, foreign investors have considered the U.S. Treasury a safe investment; however, if economic stability seems at risk, they may start to diversify away from U.S. assets. Some analysts compare this potential shift to the 2022 decision to freeze Russian assets — a moment that prompted central banks globally to stock up on physical gold rather than rely solely on dollar-backed assets.

Stock Market Reaction and the Dollar: What It Means for Global Trade

In the immediate term, American stocks and the dollar could initially benefit from these policies due to optimism around fiscal stimulus. However, some concerns loom over U.S. treasuries, given the risk of fiscal overspending that could balloon the federal deficit.

In Trump’s previous term, his economic policies caused fluctuations in the U.S. dollar, contributing to a weaker dollar and higher fiscal deficit. Should this pattern repeat, a weak dollar could have mixed implications for other economies, including India. For instance, a weaker dollar may reduce India’s import costs, supporting domestic industries that rely on imports. Yet, a volatile dollar also implies risk for the forex market, potentially impacting financial stability and central banks’ policy decisions worldwide.

The Federal Reserve’s Stance: Will Rate Cuts Continue?

A critical aspect of Trump’s policy framework is its impact on the Federal Reserve’s rate-cut agenda. Given the possibility of higher inflation due to tariffs and fiscal spending, the Fed may have to reconsider its trajectory for rate cuts. Many analysts believe that a significant departure from rate cuts could be on the horizon if the economic conditions turn inflationary.

This poses a unique challenge for countries like India, whose monetary policies often consider the Fed’s actions. If the U.S. reduces rate cuts in response to Trump’s fiscal policies, the Reserve Bank of India (RBI) may adopt a more cautious approach, waiting to stabilize uncertainties before making rate-cut decisions. Indian financial markets could face spillover effects from bond and FX volatility, potentially influencing India’s monetary policy direction in the near term.

Bitcoin and Crypto: A Boost for Digital Currency Markets?

Another headline-grabbing aspect of Trump’s economic outlook is his support for Bitcoin and plans to make the U.S. the “bitcoin superpower of the world.” Bitcoin’s recent surge past $75,000 reflects market enthusiasm over these pro-crypto statements.

A pro-Bitcoin stance from the U.S. could further legitimize cryptocurrencies, making them a core part of the financial system. This shift could attract crypto investors globally, possibly driving up crypto valuations and increasing adoption. For India, where crypto regulations remain uncertain, a U.S.-led move toward cryptocurrency acceptance may have a significant influence, pushing Indian regulators to reconsider their stance on digital currencies.

Immigration and Employment: Positive News for Indian Graduates?

Trump’s policies around immigration also stand to impact Indian students and professionals. His recent proposal to provide automatic green cards to foreign graduates from American universities could be a positive development, particularly for Indian students seeking employment opportunities in the U.S. This would enable a smoother transition to the U.S. job market, providing relief to numerous Indian students who face visa challenges post-graduation.

On the other hand, Trump’s hard stance on illegal immigration may create labor shortages in certain U.S. sectors, leading to further inflationary pressures in industries dependent on lower-wage immigrant labor.

Implications for India’s Growth and Investment

India’s economic outlook could experience mixed effects depending on how Trump’s policies shape global financial flows and trade conditions. In the near term, Trump’s proposed reduction in corporate tax rates from 21% to 15% could indirectly benefit Indian service providers by freeing up budgets for U.S.-based clients. This could enhance demand for Indian IT services, benefiting Indian tech stocks.

Further, if a weaker dollar materializes, India’s domestic investment themes and financial sectors could benefit due to lower import costs and potential for increased foreign investment. However, the broader macroeconomic landscape remains uncertain, with rising tariffs and currency volatility posing significant risks.

Elon Musk’s Role in Trump’s Administration: Impact on India

The potential induction of Elon Musk into Trump’s administration could influence India’s stance on several industries. Musk has previously advocated for lower import duties on Tesla vehicles in India, a demand the Indian government has resisted so far. With Musk now aligned with Trump’s administration, this lobbying could intensify, putting pressure on India to reconsider its position on electric vehicle imports.

Musk’s involvement might also strengthen the push for satellite spectrum allocation and space initiatives, sectors where Musk has a vested interest. This could spark further innovation and competition within India’s burgeoning space and telecommunications industries.

External Events to Watch: The Fed Meeting and China’s Stimulus

Two major external events are worth noting for their potential impact on global markets and India’s economic outlook: the Federal Reserve’s policy meeting and China’s ongoing economic stimulus discussions. The Fed’s November meeting will provide insight into its stance on inflation, which could influence Trump’s economic plans and guide monetary policy strategies globally.

Meanwhile, China’s proposed economic stimulus package, focused on property sector support and bank recapitalization, may alter trade dynamics in the Asia-Pacific region. For India, increased Chinese demand could influence commodity prices and trade balances.

Conclusion : Trump Economic Policies 2024

As Donald Trump prepares to step back into the presidency, his radical economic proposals present both challenges and opportunities. From the U.S. dollar’s strength to India’s inflation trajectory and corporate growth, the potential consequences of Trump’s economic vision are global. For India, in particular, Trump’s return could mean increased volatility but also the possibility of new avenues for trade, investment, and technological advancement.

The months ahead will be a test for central banks, governments, and corporations worldwide to navigate these shifts. For businesses and investors, staying agile and informed will be key to leveraging the opportunities and managing the risks that come with a potentially transformative Trump presidency.

Blue Techker Good post! We will be linking to this particularly great post on our site. Keep up the great writing